China Luxury Market Will be the Largest in the World

Bain predicts China will be the largest luxury market by 2025. This is after Chinese spending has doubled. Bain states that luxury leather goods, fashion jewelry, and cosmetics sales are on the rise in China. They will surpass all other markets within three years.

According to consultancy Bain report, more than a fifth of global consumer spending on luxury goods in 2021 was made in China. This is due to online shopping and duty-free shopping.

China accounted for around 21 percent of the global luxury product spending in 2021. Bain & Company predicts that the Chinese will be the largest luxury market in the world by 2025.

In this article, we will show you the best strategies to sell overseas products on China’s luxury market.

Overview of the Luxury Market in China

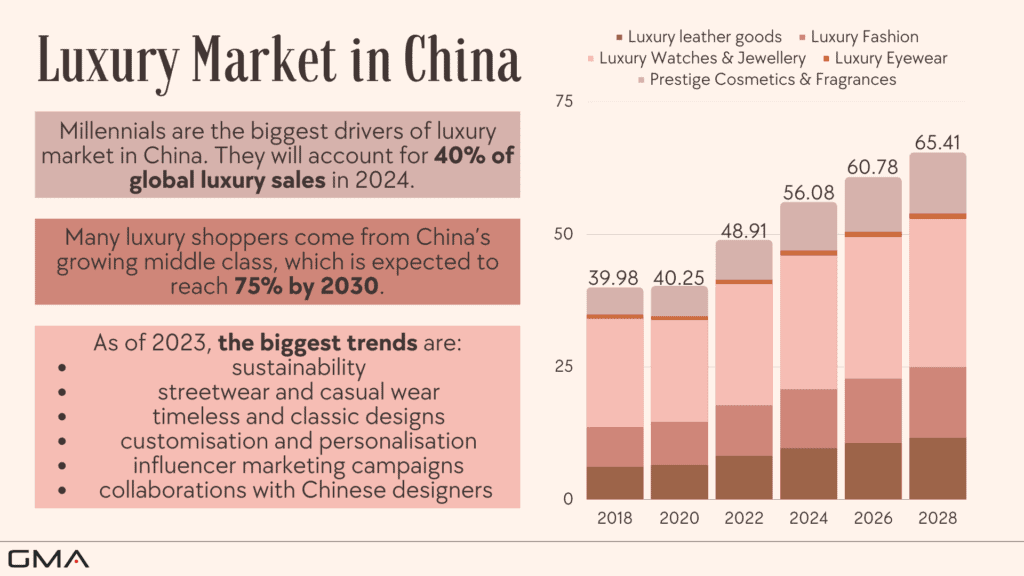

In 2022, the luxury market in China was estimated to be worth around $48 billion, and it is expected to continue growing in the coming years.

The largest segments of the luxury market in China are fashion and accessories, followed by beauty and personal care products. Luxury cars and watches are also popular among Chinese luxury consumers.

At the end of 2020, China surpassed the USA in the Fashion & Apparel Market. Over the past 10 years, it has grown almost 4 times bigger, reaching $266 billion in 2022. China’s fashion market is growing at a rate of 25% per year.

On top of that, China is not only a lucrative market for brands, but it is also a promising one as according to McKinsey, Chinese shoppers will account for 40% of the world’s luxury spending by 2025. With this huge potential market, brands can possibly attract more than 1 million consumers just by focusing their marketing strategies on China.

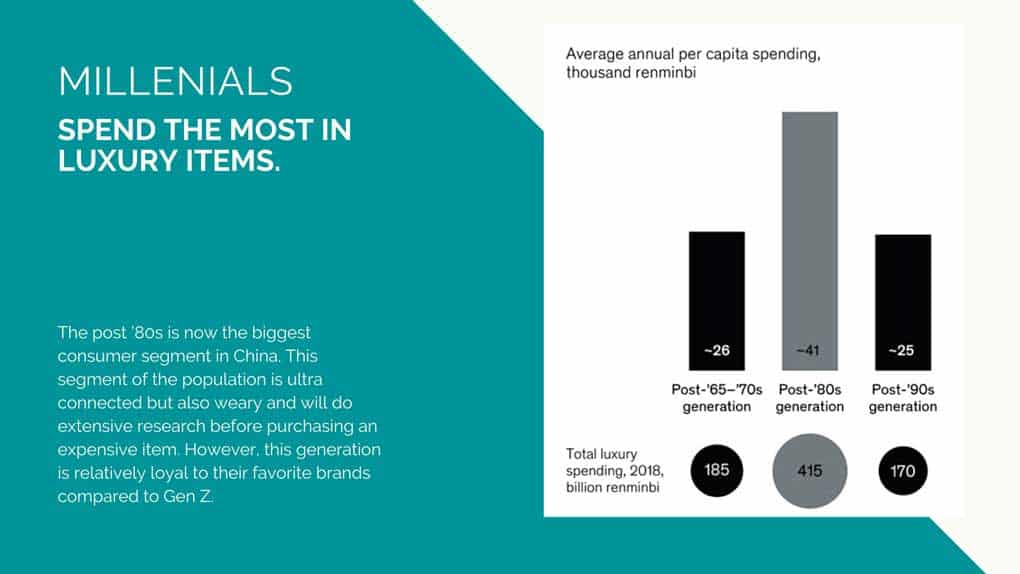

Millennials and Gen Z Shoppers are the Best Clients of Luxury Brands

Gen Z shoppers continue to emerge as a source for market growth and a driver of increased digitization, while millennials make up the core of Tmall’s luxury fashion, lifestyle, and beauty customers.

These shoppers are a smart target audience for top luxury brands that know how to recognize their purchasing power, interests, shopping habits and preferences. This includes cross-brand collaboration and personalized products made exclusively for Mainland China.

Best Strategies to Enter The Luxury Market in China

There are many aspects to consider when entering the luxury goods market in China and your marketing strategies will always depend on the luxury sector, the target audience and your budget. Let’s take a look at the key considerations.

Digitalization is the Key In China

With the rising influence of younger consumers, luxury brands in China are expanding their presence on online channels. The omnichannel expansion was increased across brands’ virtual and physical footprints as well as cross-channel efforts like luxury live streaming from pop-up shops.

However, online and offline marketing activation at the current scale is very expensive and is a major driver of the performance gap between smaller and larger brands.

Different categories of luxury goods experienced growth at different rates in China. With a growth rate of around 60 percent, leather goods grew the fastest followed by fashion clothing and jewelry.

Being Present On Chinese Social Media

China has become a major player in the luxury market and is expected to become the world’s largest luxury market. One of the key reasons for this growth is the increasing presence of luxury brands on Chinese social media platforms that influence luxury consumption.

With over 1.4 billion people, China has the largest population in the world and a rapidly growing middle class that is becoming increasingly interested in luxury goods. Social media platforms like WeChat, Weibo, and Douyin (TikTok) have become essential tools for luxury brands to reach this audience.

By leveraging these platforms, luxury brands are able to engage with Chinese consumers in a more personalized and authentic way. They can create content that resonates with their target audience, build brand awareness, and drive sales.

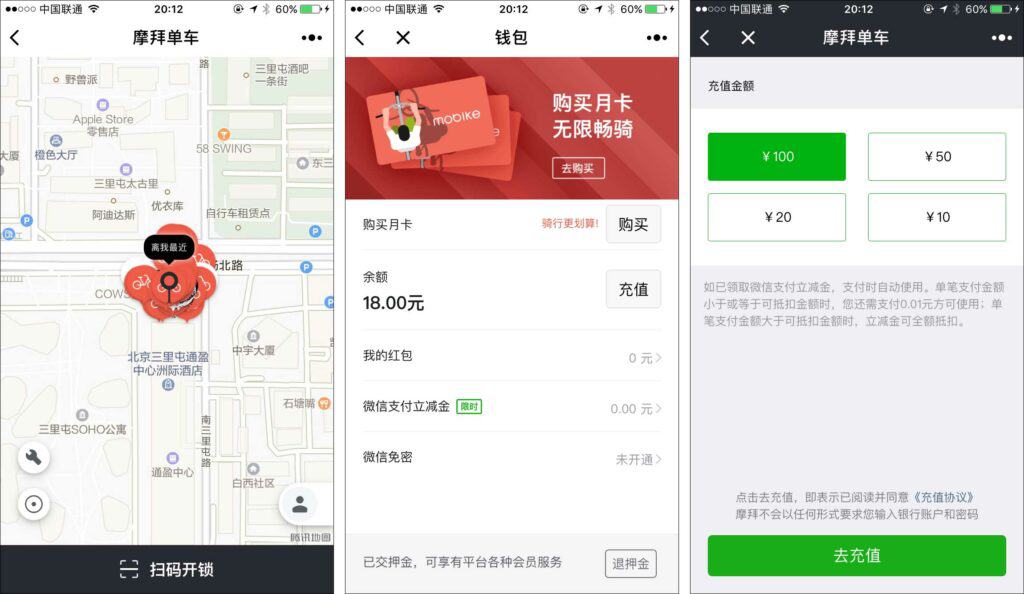

In addition, social media platforms in China offer unique features that are not available on Western platforms.

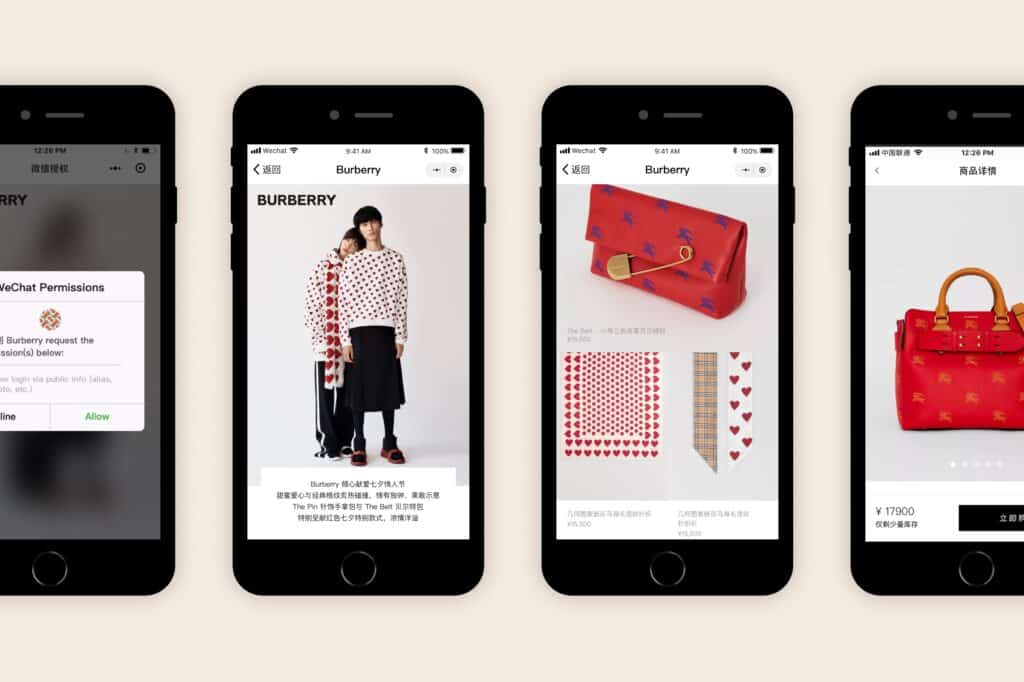

For example, WeChat allows brands to create mini-programs that enable consumers to purchase products directly within the app. This makes it easier for consumers to make purchases and helps brands to drive sales.

Overall, the increasing presence of luxury brands on Chinese social media platforms is a key factor in the growth of the luxury market in China. As more brands continue to invest in these platforms, we can expect to see the emergence of new customers from Gen Z entering the luxury market.

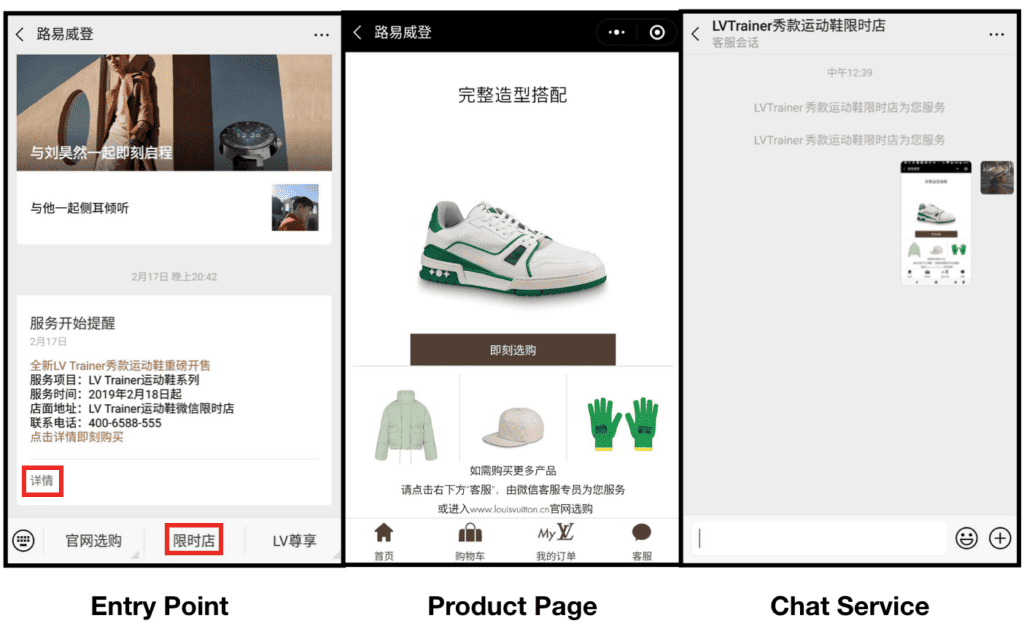

One example of a successful luxury brand using Chinese social media is Louis Vuitton. The brand has a strong presence on WeChat, which is one of the most popular social media platforms in China. Louis Vuitton has leveraged the platform to launch exclusive collections, host live events, and engage with its followers through interactive campaigns.

The brand has also collaborated with popular Chinese celebrities and influencers to reach a wider audience and increase its brand awareness.

Additionally, Louis Vuitton has used Weibo, another popular social media platform in China, to share its latest collections and engage with its followers through interactive campaigns.

Overall, Louis Vuitton’s successful use of Chinese social media has helped the brand to maintain its luxury image in China and increase its customer base.

Collaborating with KOLs (Key Opinion Leaders)

KOL (Key Opinion Leader) marketing has become a popular strategy for luxury brands to reach Chinese consumers. In China, KOLs are often referred to as Wanghongs, which translates to “internet celebrities.” These individuals have a large following on social media platforms like WeChat, Weibo, and Douyin, and they have the power to influence their followers’ purchasing decisions.

Luxury brands have been partnering with Wanghongs to promote their products and increase brand awareness. These collaborations typically involve the KOL creating content featuring the brand’s products, which is then shared on their social media platforms. This content can take the form of product reviews, unboxing videos, or even live-streamed events.

One example of a luxury brand that has successfully used KOL marketing in China is Burberry. In 2019, the brand partnered with Chinese actress Wanghong Zhou Dongyu to promote its Lunar New Year collection. The campaign included a short film featuring Zhou wearing Burberry’s latest designs, which was shared on social media platforms and in Burberry’s stores.

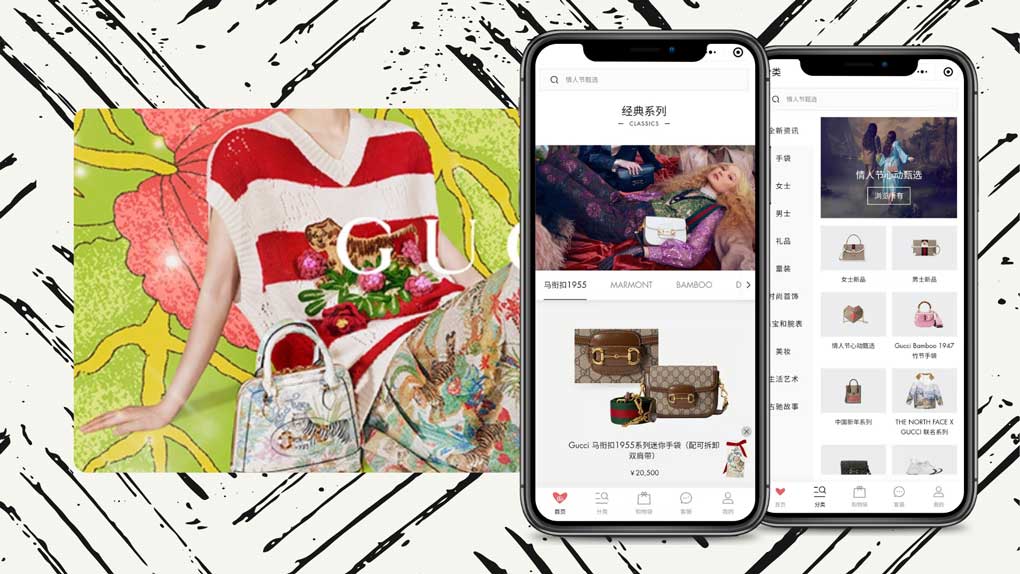

Another example is Gucci, which has collaborated with Wanghongs like Li Jiaqi and Austin Li to promote its products in China. Gucci also created a mini-program on WeChat that allowed customers to virtually try on its shoes and share the results on social media.

Overall, KOL marketing has proven to be an effective way for luxury brands to connect with Chinese consumers and increase their brand awareness in the country.

Tmall Luxury Pavilion: E-commerce in China is not something to be afraid of for luxury brands

Tmall, one of China’s largest e-commerce platforms, launched the Luxury Pavilion in 2017. The app currently houses 28 brands. The Luxury Pavilion is, in reality, a communication channel that targets a different audience than what they use in Europe. Tmall is estimated to bring in around 15,000 euros per year and an average Chinese consumer spends 90,000. RMB each year.

Hainan and Chinese tourists

Hainan is a beautiful tropical island province located in southern China. It has become a popular destination among Chinese tourists in recent years, thanks to its warm climate, stunning beaches, and rich cultural heritage.

Chinese tourists are a major source of revenue for Hainan’s tourism industry. In fact, the number of Chinese tourists visiting Hainan has been increasing steadily over the past few years, with more than 83 million visitors in 2019 alone.

Many Chinese tourists are drawn to Hainan’s natural beauty, with its pristine beaches, lush forests, and crystal-clear waters. The island is also home to a number of cultural attractions, such as ancient temples, traditional villages, and museums showcasing the region’s history and heritage.

In addition to its natural and cultural attractions, Hainan has also become known for its luxury resorts and shopping centers, which cater to the growing number of affluent Chinese tourists looking for high-end experiences.

Duty-free shopping in Hainan has aided the growth of the country’s luxury market. Last year, about 95% of Hainan’s duty-free sales were from personal luxuries.

According to the report, more than half of the goods sold were cosmetics from luxury brands.

Case Study

In recent years, the French fashion house Louis Vuitton has become a leading luxury brand in China. The company has achieved success by tailoring its marketing strategy to the unique characteristics of the Chinese market.

One of the key strategies that Louis Vuitton has employed is to create a strong digital presence in China. The company has launched several online platforms, including a WeChat account and a mobile app, to engage with Chinese consumers. These platforms allow Louis Vuitton to showcase its products and connect with customers in a personalized way.

Another strategy that Louis Vuitton has used is to adapt its product offerings to the Chinese market. For example, the company has created special collections featuring Chinese motifs and designs that appeal to Chinese consumers. Additionally, Louis Vuitton has opened stores in strategic locations throughout China, such as in high-end shopping malls and luxury hotels.

Louis Vuitton has also invested heavily in building brand awareness in China. The company has sponsored high-profile events, such as the China International Film Festival and the China Open tennis tournament, to increase its visibility among Chinese consumers.

Overall, Louis Vuitton’s success in China can be attributed to its ability to understand and adapt to the unique characteristics of the Chinese market. By creating a strong digital presence, adapting its product offerings, and building brand awareness, the company has established itself as a leading luxury brand in China.

Fashion 2025: How brands should navigate in China?

One unique aspect of the Chinese luxury market is the importance of e-commerce. Online sales of luxury goods in China have been growing rapidly, with many consumers preferring to shop online due to the convenience and wider selection of products. In fact, more than 40% of luxury purchases in China are made online.

For example, China’s online luxury sales grew by 31% percent in 2022, reaching US$31.8 billion (RMB 220 billion) during the year. This is much faster than offline stores, which are the primary and conventional distribution channels for luxury products.

The Covid-19 pandemic, and the related travel restrictions, have had an effect on where purchases were made. More than 90% of Chinese consumers spent on luxury goods domestically.

Another important factor in the Chinese luxury market is the increasing demand for sustainable and socially responsible products. Many Chinese consumers are becoming more conscious of the environmental and social impact of their purchases, and are seeking out brands that prioritize sustainability and ethical practices.

Overall, the luxury market in China offers significant opportunities for brands that can successfully navigate the unique preferences and trends of Chinese consumers.

We are your local partner in China!

China will become the largest luxury market in the world in the near future. The country’s growing middle and upper classes, increasing disposable income, and changing attitudes towards luxury goods have all contributed to this trend.

However, it is important to note that unexpected events or changes in the global economy could potentially impact this prediction.

We are a China-based marketing agency offering cost-effective solutions to foreign brands interested in tapping into the Chinese market. Our team of Chinese and foreign experts has the experience and know-how needed to succeed in this lucrative, yet complicated market.

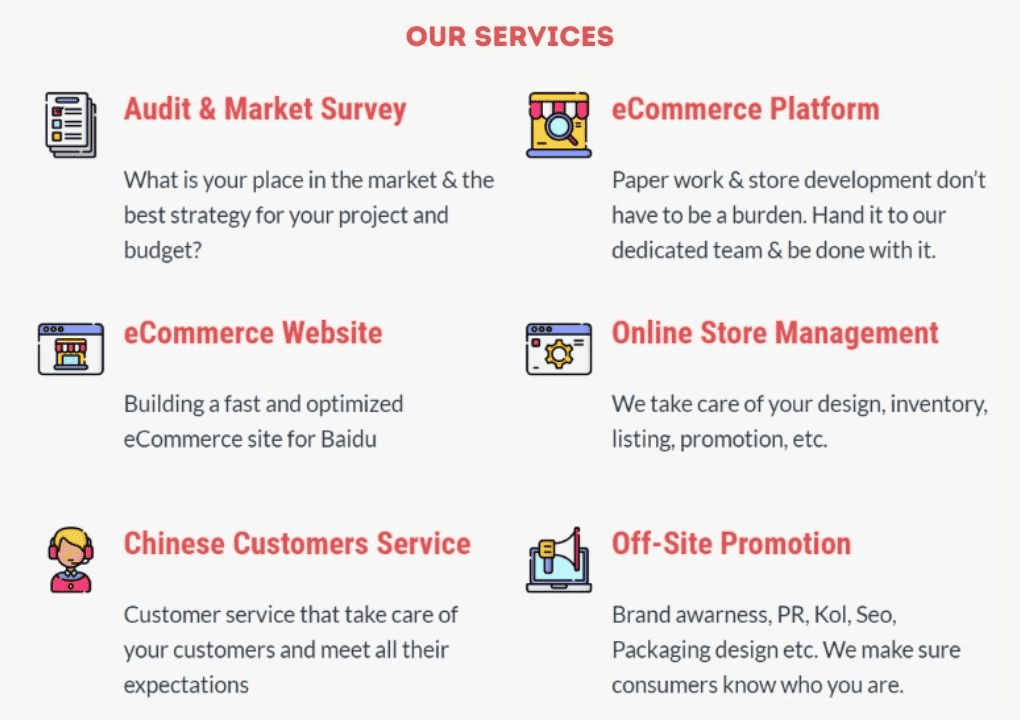

Gentlemen Marketing Agency offers many digital marketing and e-commerce solutions, such as web design, e-commerce and social media marketing strategies, localization, market research, KOL marketing, and more.

Don’t hesitate to leave us a comment or contact us, so that we can schedule a free consultation with one of our experts, that will learn about your brand and present you the best solutions for your China market strategy.