Why you should offer mobile payment options to Chinese tourists?

If you’re a business owner or executive looking to attract Chinese tourists, offering mobile payment options should be a top priority. With over 150 million Chinese tourists traveling overseas each year, their preference for mobile payments is growing rapidly.

In fact, Chinese tourists use mobile payment platforms like Alipay and WeChat Pay to pay for goods and services while traveling abroad. If you understand the importance of mobile payments in China’s consumer culture and implement these options into your business strategy, you’ll be able to tap into this lucrative market, improve customer satisfaction, and increase sales.

Key Takeaways

- Offering mobile payment options like Alipay and WeChat Pay to Chinese tourists is crucial for businesses looking to tap into this growing market segment and increase sales revenue.

- Mobile payments dominate in China, with 90%+ transactions on Alipay and WeChat Pay. Integrating these methods into your strategy boosts customer satisfaction and gives a competitive edge over non-adopting rivals.

Importance Of The Chinese Tourist Market For International Businesses

In recent years, China has emerged as one of the world’s largest sources of outbound tourists with millions traveling abroad annually. The economic impact of catering to this demographic cannot be overstated; given their strong preference for mobile payment options like Alipay and WeChat Pay over traditional cash or bank cards transactions while traveling.

For instance, Chinese tourists’ top three categories of spending while abroad are:

- shopping (e.g., luxury brands)

- accommodations (e.g., hotels)

- food & beverages.

By effectively targeting this lucrative market segment through cross-cultural marketing efforts including promotion on popular Chinese social media platforms or partnering with key opinion leaders (KOLs), you could potentially increase sales revenue by offering a seamless transaction experience tailored specifically toward these consumers’ needs.

Understanding The Chinese Tourist Market

As the world’s largest tourist market, measured by both trips and expenditures, Chinese tourists spent an astounding $106 billion on international travel in 2021 alone.

One unique aspect of their spending habits is their reliance on mobile payments while traveling abroad; 93% would consider using it if more overseas merchants accepted these options. Furthermore, 91% are willing to spend more when foreign businesses support Chinese mobile payment platforms like Alipay or WeChat Pay.

Moreover, since most Chinese netizens rely on digital app ecosystems like Alipay and WeChat Pay in their daily life, they find it more convenient to continue using these platforms even when traveling overseas.

For businesses looking to attract more Chinese tourists and boost revenue streams from this growing market segment, offering mobile payment options is a crucial step that cannot be ignored.

Mobile Payment Landscape In China

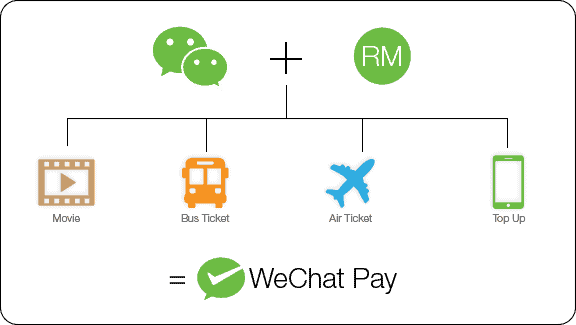

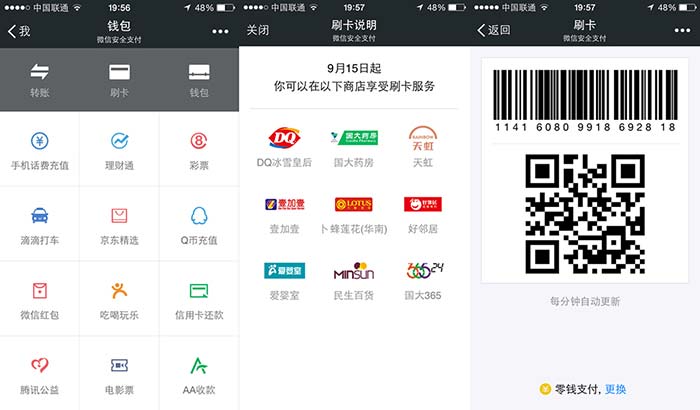

Alipay And WeChat Pay are the leading players in China’s mobile payment landscape, with around 900 million Chinese users’ mobile payments running through them.

They were able to gain this dominant position by leveraging their pre-existing user base (WeChat and Alibaba) to introduce new payment technologies that use QR codes and in-app features to pay for goods.

In China, mobile payments are not just a trend but have become an integral part of daily life. From street vendors to high-end luxury stores, consumers can pay for almost anything with a few taps on their smartphones using Alipay or WeChat Pay.

In fact, cash and even credit cards have become less common as the majority of people use these digital wallets for financial transactions.

Mobile Payment Adoption Rates Among Chinese Tourists

In recent years, there has been a significant increase in the number of Chinese tourists using mobile payment options while traveling abroad.

According to recent studies, 77% of Chinese tourists spent more money via mobile payment during their most recent overseas trip than on previous trips using traditional payment methods like cash or credit cards. This trend is expected to continue as more and more Chinese consumers are comfortable with digital wallets and contactless payments in their everyday lives.

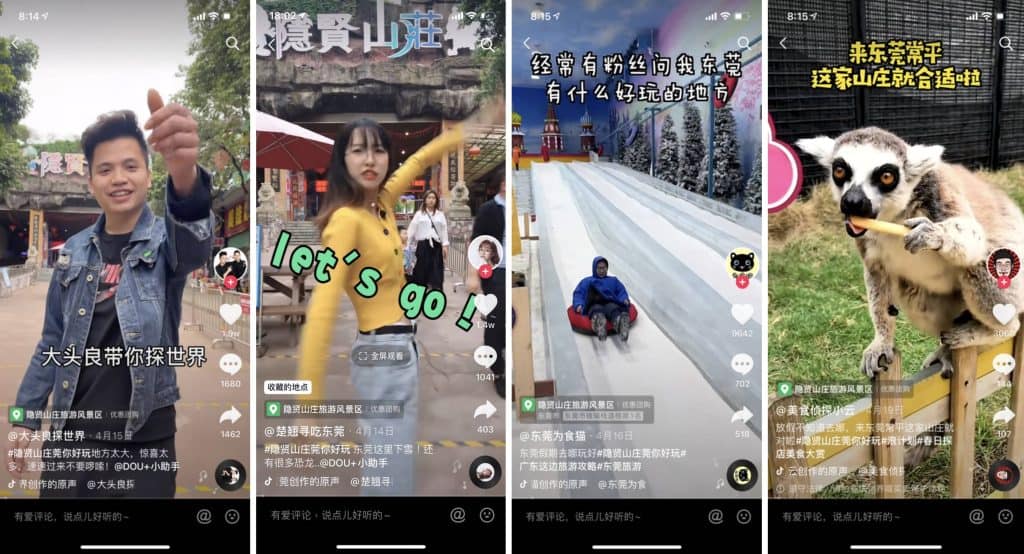

Through social media platforms like Weibo and Douyin or engaging KOLs (Key Opinion Leaders), businesses can promote mobile payment acceptance successfully.

Benefits Of Offering Mobile Payment Options

1. Convenience For Chinese Tourists

- Mobile payments provide convenience, leading to higher sales.

- Digital wallets eliminate the need for physical cash or cards.

- Language barriers are eliminated, reducing checkout wait times.

- A luxury boutique in NYC saw a 30% sales increase with WeChat Pay.

2. Increased Customer Satisfaction And Loyalty

- 91% of Chinese tourists would spend more if mobile payments were available.

- Accepting Alipay or WeChat Pay taps into their purchasing power.

- Mobile payments improve customer loyalty and give a competitive edge.

3. Potential For Higher Sales And Revenue

- Chinese tourists spent over $106 billion overseas in 2021.

- Offering mobile payments caters to their preferred method.

- Businesses receive 2-3 times more purchases from Chinese customers.

4. Competitive Advantage Over Businesses That Don’t Accept Mobile Payments

- Businesses that accept mobile payments attract more customers.

- Mobile payments offer convenience and electronic receipts.

- 65% of Chinese tourists used mobile payments on their last trip.

Overcoming Challenges And Implementation Strategies

Technical Considerations And Infrastructure Requirements

Companies must ensure that their systems can effectively integrate with various payment providers, comply with regulatory requirements, and handle transactions in the appropriate language and currency.

For example, companies should partner with local businesses like tour operators or hotels to provide a seamless payment experience for travelers. This can help increase reach among Chinese tourists while also making the process more convenient for them.

Partnering With Mobile Payment Providers Or Third-party Payment Processors

Partnering with a trusted mobile payment provider or a third-party payment processor can be incredibly valuable. These providers have already established the necessary technology and security protocols to safely process transactions, making it easier for businesses to offer mobile payments without having to build everything from scratch.

For example, companies like Adyen, BlueSnap, and Payoneer are popular third-party payment processors that provide cross-border payment options and fraud prevention measures.

Staff Training And Customer Education

While these payment methods are familiar to Chinese consumers, our personnel may require technical training to operate effectively.

Furthermore, if we expand into industries like telemedicine services or medical bill payments, an emphasis on educating both staff and clients will be necessary. It’s vital that employees understand the technology behind these systems and can answer any questions from consumers who may not be as familiar with digital payment methods.

Case Studies And Success Stories

Integrating mobile payments into your operation has been shown to increase sales revenue as well. Retail businesses that offer Alipay or WeChat Pay as payment options see an average 30-40% increase in transaction volume from Chinese customers.

This not only means more purchases but also larger purchase amounts due to the ease of making secure transactions with mobile wallets.

Several case studies have shown that implementing mobile payment options reaps enormous rewards in terms of sales growth and improved market position for companies targeting this market segment.

One such example is the luxury fashion brand Burberry, which partnered with Tencent to enable WeChat Pay at its flagship store in London.

Another success story comes from Norwegian Air Shuttle. The airline introduced Alipay as a payment option for Chinese travelers booking flights through its website or app.

Marketing And Promotion

Promoting Mobile Payment Acceptance Through Marketing Channels

Marketing efforts should focus on creating awareness that the merchant accepts mobile payments to make Chinese tourists feel welcome.

This can be done by leveraging social media platforms like WeChat and Sina Weibo, which have large user bases in China. In-app coupons and marketing campaigns can also be set up to attract customers through these platforms.

By promoting mobile payment acceptance through various channels, businesses can tap into the growing demand for digital payments from Chinese tourists while providing added convenience and a positive customer experience.

Leveraging Chinese Social Media And Digital Platforms

Chinese consumers are highly active on platforms like WeChat, which has over one billion active users.

By integrating mobile payments with social media promotions and advertisements, businesses can reach this market in an effective way. For example, partnering with popular influencers or key opinion leaders (KOLs) on WeChat can help promote your business and increase brand awareness among Chinese tourists.

Engaging With Chinese Influencers And Key Opinion Leaders (KOLs)

In China, KOLs have gained widespread popularity and are known for their significant influence on consumer behavior.

To successfully engage with KOLs in China, marketers must first identify the right influencer for their target audience and product offering. Generally speaking, KOL marketing in China targets individuals between 20 and 30 years old – especially post-90s to 00s internet users – regardless of their city of residence.

Once identified, brands should work closely with the influencer throughout the campaign process to ensure that messaging is consistent with brand values and resonates well with the intended audience.

We Can Help You Adopt the Chinese Payment System in Your Company

The growth of Chinese outbound tourism has led to a significant increase in spending by affluent Chinese consumers, who prioritize convenience and speed when it comes to payments.

Brands that cater to this market must offer mobile payment platforms like Alipay and WeChat Pay if they want to attract and retain customers, boost customer loyalty, and position themselves as leaders in the industry.

Overcoming technical challenges and implementing these solutions may seem daunting at first but partnering with third-party payment providers can make the process smoother.

Furthermore, partnering with an experienced agency like ours, that specializes in marketing and digital promotion can complement the implementation of mobile payment solutions. With 20 years of experience, we can provide valuable guidance and support in promoting the adoption of mobile payments on social media and digital platforms.

We can help create targeted marketing campaigns, craft compelling content, and optimize digital channels to raise awareness about the convenience and benefits of mobile payments for Chinese tourists. Leveraging our expertise, we can effectively communicate your business’s adoption of mobile payments, enabling you to attract Chinese tourists and gain a competitive edge in the market.

Don’t hesitate to contact us today!