Sales are recovering in China according to top U.S. firms

Investors are watching China closely for the economic trend following the coronavirus.

Recent earnings reports from leading Western companies with a strong presence in China are encouraging.

Of course, data from China itself has suggested that a rebound is beginning to take hold.

But many investors and economists believe that official Chinese government figures contain enough grains of salt to fill the world’s oceans.

That’s why it’s perhaps even more important to hear what the leaders of major U.S. and European multinationals are saying about a possible turnaround in China. And there are beginning to be some signs of cautious optimism.

We’ll see a little more of that in the rest of this article, so pay attention.

- Large blue-chip companies hope China will recover

- Working conditions seem to be gradually improving in all areas.

- False hope or real recovery?

I. Large companies hope that China will recover

Jeans giant Levi Strauss (LEVI) reported in its results release earlier this month that consumers were starting to shop again and that demand was steadily improving, even in the coronavirus epicenter.

“Although traffic remains well below previous year’s levels, we have now reopened all of our company’s stores in China, including our flagship store in Wuhan,” said Harmit Singh, Levi Strauss CFO, during a conference call with analysts earlier this month.

Mr. Singh added that sales have improved every week since the stores reopened in March.

And digital sales in China increased in March compared to last year.

- Gross profit margins are also higher, Singh said.

- Industrial toolmaker Snap-on (SNA) also hinted at a possible turnaround in China.

Its CEO, Nicholas Pinchuk, told analysts in his earnings appeal to investors this month that China is “showing some rays of light”.

“Restaurants are opening and people are driving in droves,” Pinchuk said.

- it is hard time for small and medium brands in China (without cashflow)

In April, the major bank State Street (STT) also told analysts that its operations in Hangzhou were also returning to normal, with about 75 to 80 percent of its employees returning to work after getting the green light in mid-March,

“In the beginning, people wore masks. And now you see a much more normal working environment,” State Street CEO Ronald Philip O’Hanley said during the bank’s latest earnings appeal, referring to the fact that fewer workers in China now wear masks.

“I think it will stay that way as long as there is no further epidemic,” he added. O’Hanley noted, however, that workers are still being checked for temperature before entering the offices.

II. Working conditions seem to be gradually improving in all areas.

Murray Auchincloss, BP’s chief financial officer, told a conference call on Tuesday that demand in the lubricants sector has “started to recover in China in recent weeks”.

Meanwhile, mask and fan manufacturer 3M (MMM) said it was also experiencing a rebound in China.

“We’re seeing growth again in China. It’s pretty big business,” 3M CEO Michael Roman said in a conference call with analysts on Tuesday.

“We see the economy starting to show signs of recovery…”

Even construction equipment giant Caterpillar (CAT), which reported a massive drop in sales from Asia (and China in particular) in the first quarter, is beginning to see signs of the proverbial green shoots.

“The situation in China has obviously improved as the pandemic has abated in that country. As a result, all of our facilities are now operating in China again, and our suppliers are doing much better there as well,” said Jim Umpleby, Caterpillar CEO, in a conference call on Tuesday.

III. False hope or real recovery?

We still don’t know if the worst is really over for China.

Many of its major trading partners, namely the United States and Europe, are only beginning to see the worst negative effects of the Covid-19 outbreak.

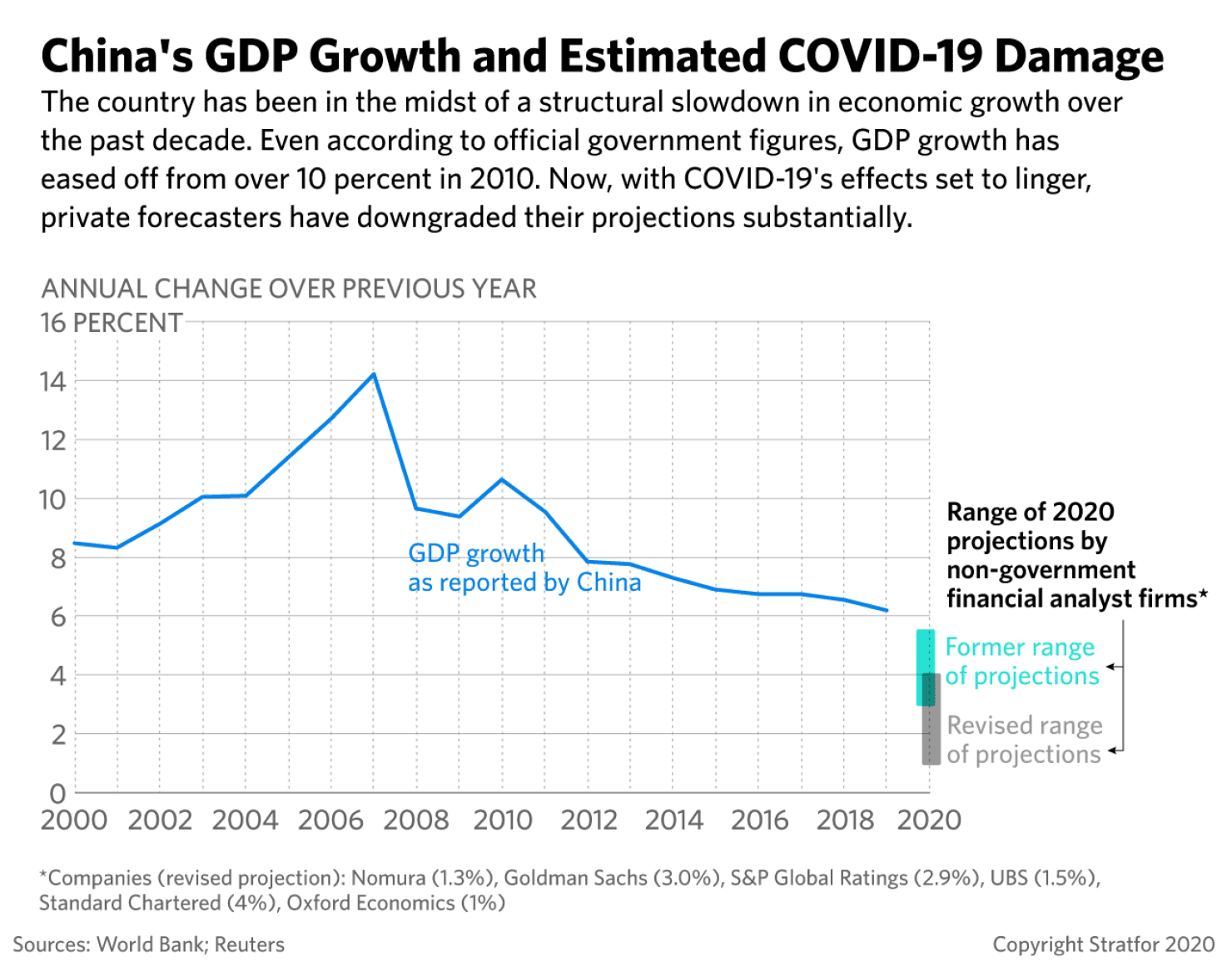

This is one of the main reasons why Moody’s economists predict that China’s economy will grow by only 1% this year.

According to Moody’s, China will be held back by the weakness of its major trading partners.

Moody’s expects the U.S. economy to shrink by 5.7% this year and the eurozone to contract by 6.5%.

Fortunately, Moody’s expects the Chinese economy to rebound by 7.1% for the year 2021 as a whole, “partly reflecting a recovery in demand from its trading partners”.

But even that could be overly optimistic, according to Giorgio Caputo, senior fund manager and head of a multi-asset strategy at J O Hambro Capital Management.

Caputo points out that any surge in Chinese demand could be temporary, as there are legitimate concerns about the second wave of Covid-19 later this year.

More information about Italian China business

In conclusion

With this in mind, he believes that any economic boom may not last unless there is an effective vaccine or antiviral treatment against coronavirus.

Beyond that, social distancing measures that could harm the global economy could remain the new norm.

It may also be wrong to assume that the United States and Western countries will rebound as quickly as China, a country with a highly government-managed and government-controlled economy.

“What kind of reading can one really make of China, since it is rather an autocratic society,” Caputo said. “When the order just reopens factories, you reopen factories.”

Read more