Public and private investors fuel China’s startups

It can be difficult for a start-up to get the attention of Chinese private investors. Even though they have the money to invest, there are many factors that go into their decision-making process. In order to increase your chances of getting funded, you need to make sure that you stand out from the crowd and present yourself in the best light possible. Here are a few tips on how to do just that.

Chinese Companies are Living the Global Stocks Market

Many high-profile chinese companies are de-listing from global stock exchanges like DiDi and China Mobile. Then there is the prohibition of new listings. It is difficult to quantify the amount of lost business because it is impossible to know what would happen if the U.S. didn’t require more disclosure while China insists on less.

Beijing demands more data control. It is telling its companies that they cannot travel overseas without passing security checks. This basically means that they won’t share any information. The Chinese market cap in America has plunged to around 50%, according to me. Because sentiment isn’t always this negative, there will be a rebound. It’s been a huge hit for this segment of the market.

The official reason: Data Loss

The Chinese are also more concerned with data loss. Data is being treated the same way as manufacturing 10 years ago. It’s allowed for manufacturing to enter China, but it is not allowed to leave. It is permitted to flow data into China; it’s not allowed for it to leave.

This means that if you have Chinese consumer information, you can’t share it with any foreign regulator.

Wall Street has had less pressure to say “Don’t take away our fees,” because the Chinese just said, “Well, we’re not going to allow people to list in America anyway.” This is because China has made this business more lucrative than ever before.

The government is encouraging this trend by making it easier for startups to get funding

Beijing supports entrepreneurship and is trying to shift China’s economy away from heavy industries towards a service-oriented model that is driven by consumption. As the Chinese government pushes measures to reform China’s economy, create new jobs, and reduce infrastructure spending, there are now more than $450 billion of venture capital available to local governments.

These huge sums attract the attention of Western startups. Many of these startups are having difficulty accessing VC in their home country. While American VCs tend to avoid investing in hardware tech, Chinese VCs embrace them. China offers many advantages, including burgeoning consumer demand as well as mass manufacturing.

Gerrans from Sanovas says that innovation capital in America has been dead for a while. “Nobody wants anymore to invest in ‘development risks’. They want short-term, immediate returns. Many Western startups will find it refreshing and energizing to negotiate Chinese VC investments around innovation and long-term thinking.

The role of the Committee on Foreign Investment in the United States, which has the power of vetoing acquisitions of U.S. businesses on national security grounds, could complicate relations between Chinese VC firms. Washington is considering expanding the CFIUS’s remit to include joint ventures as well as minority stakes.

According to Deloitte’s Chou, “This prospect indicates that more Chinese VC firms are looking elsewhere for investment.” “Israel is becoming a popular destination for investing in transformative startups.”

Private investors have been fueling China’s startup scene for a few years now

but public investors are starting to get in on the action;

Venture capital (VC), investment in China has exploded due to increased public and private funding. Figures from financial services provider KPMG show that over US$31 Billion was invested last year in Chinese startups. This is three-quarters of the total U.S. investment, up from $27.4B in 2015.

The year ahead looks set to break another record. Chinese startups invested $10.7 billion in the second quarter of 2017. Didi Chuxing, a Beijing-based ride-hailing company, raised $5.5 billion in its largest-ever private venture funding round.

Contrary to a decade ago the majority of Chinese VC capital now comes from domestic sources. China’s economic growth is creating an ever greater pool of investment-hungry, wealthy Chinese entrepreneurs. The government considers public VC funds the best way to spur homegrown innovation.

Calvin Cheng, East West Bank’s managing Director of Tech and Growth Banking China, says that the early days of China-based Venture Capital were dominated by U.S. funds. But things have changed. Chinese VC investors have both the cash and the sophistication to invest in innovative business models. They are able to identify unique business models.

Deloitte and China Venture report that China has 98 unicorns (startups worth more than $1 billion). Many of these are now backed or supported by the JD.com e-commerce site, which is part of the BAT (Baidu. Alibaba. Tencent).

This influx of money is helping to fuel China’s tech industry

China-based VC investments are still dominated by the IT and internet sectors across the industrial spectrum. The sector is seeing money pour into big data, Fintech and artificial intelligence (AI), as well as robotics, and the cloud.

William Chou, National TMT Industry Lead for Deloitte China, says that companies in the internet and IT sectors are often less capital-intensive and investors expect faster returns than those in traditional businesses.

The booming Chinese AI sector, which is supported by large amounts of government funding, is one of the most sought-after destinations for Chinese VC. Recently, the Chinese government stated that it plans to make China the world’s top AI power by 2030. Meanwhile, the Chinese Academy of Sciences’ Institute of Automation (a partnership of universities, businesses) has already invested RMB 1 Billion (US$150 Mn) in VC funding for AI development.

SenseTime, a Chinese AI startup, closed a Series B round of $410 million in July. This was the company’s largest-ever private financing round. It also claims a valuation exceeding RMB 10 Billion (US$1.47 Billion), which would make it one of China’s most valuable unicorns.

China’s vast smartphone user base and burgeoning online m-commerce industry make it a great place to promote AI development. Tencent, Baidu, and Alibaba have the ideal platform to develop cutting-edge AI systems. The Economist reported that the number of Chinese AI-related patent applications made between 2010-2014 was 300 percent higher than the five-year prior. East-West Bank has partnered with Sequoia Capital, Mobvoi, a Google-backed Chinese unicorn, which specializes in AI and voice recognition technology.

How to get the attention on Chinese Private Investors?

China is a country where trust cannot be earned by default. It is necessary to establish a good reputation and visibility in your field.

- This is possible with SEO and PR. You will need to create a Chinese version. It must be hosted in China, or in another country. To drive traffic to your prospects, make sure you use the correct search keywords.

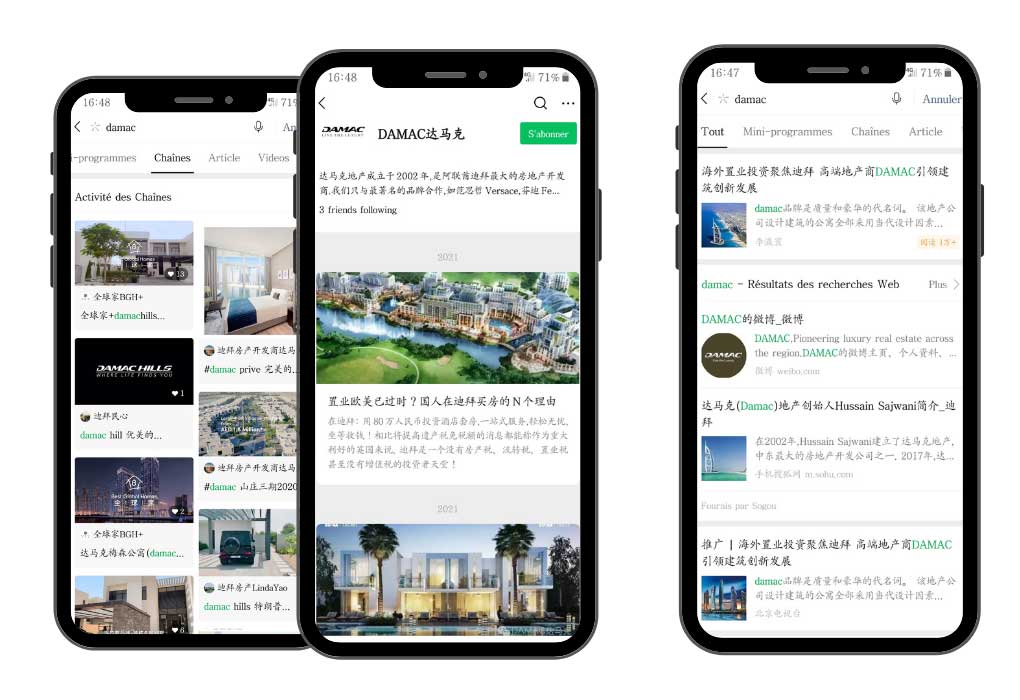

- WeChat is your first step to convert your prospects. You need to know how to use WeChat in a professional setting in order to promote your offers.

- A PR campaign must be well-planned, have a deep understanding of the target audience, and be able to communicate messages at the right moment. Over the last few years, native online media and news platforms have collaborated and offer many opportunities for corporate storytelling as well as effective media relations.

- Zhihu is China’s largest forum. Zhihu, a social-answering website primarily used by Chinese, has 160 million registered users and 26 million users per day, spending an average of one hour per day on the site. It also boasts a very old user base for a social app: 78.2% are over 25 years of age.

China’s solution to fund raising: Lead generation and E-Reputation

The main challenge when looking for investments in China is to build your Online Reputation. A strong online reputation will result in Lead generation.

Storytelling requires creativity, vision, and skill. It is a key component of most successful marketing campaigns. It distinguishes vibrant businesses from small businesses, loyal customers from temporary shoppers, and makes them stand out from the rest. A well-told story can increase awareness and create a personal connection between the reader and the teller. Personal stories are easy to remember and make you more accessible. To make a true connection, you must focus on the audience.

Be authentic: Stories create emotional connections. Storytelling allows startups to build deeper relationships with their audience. This is a powerful way to learn about the brand’s history.

But let’s deep dive into the solution to get Chinese investors attention

Wechat:

WeChat is China’s most popular social network. Although it looks similar to Facebook, WeChat offers many more features, such as booking a hotel, buying movie tickets, paying their electricity bill, or calling a restaurant and booking a table. A company can set up a Wechat H5brochure account. WeChat accounts allow social network users to subscribe for news about the company’s activities. Companies that wish to expand their China presence should not use WeChat.

Chinese Company Introduction on Wechat

A pitch deck ppt/pdf, and a H5 brochure Chinese that we can share with our investor network and prospects.

A Chinese Mandarin introduction of your company and project shows engagement and helps prospects understand why they should invest.

A Chinese introduction will always be more popular with Chinese investors than an English PDF. (This will eventually end up at the bottom of the 100 demands they receive each day).

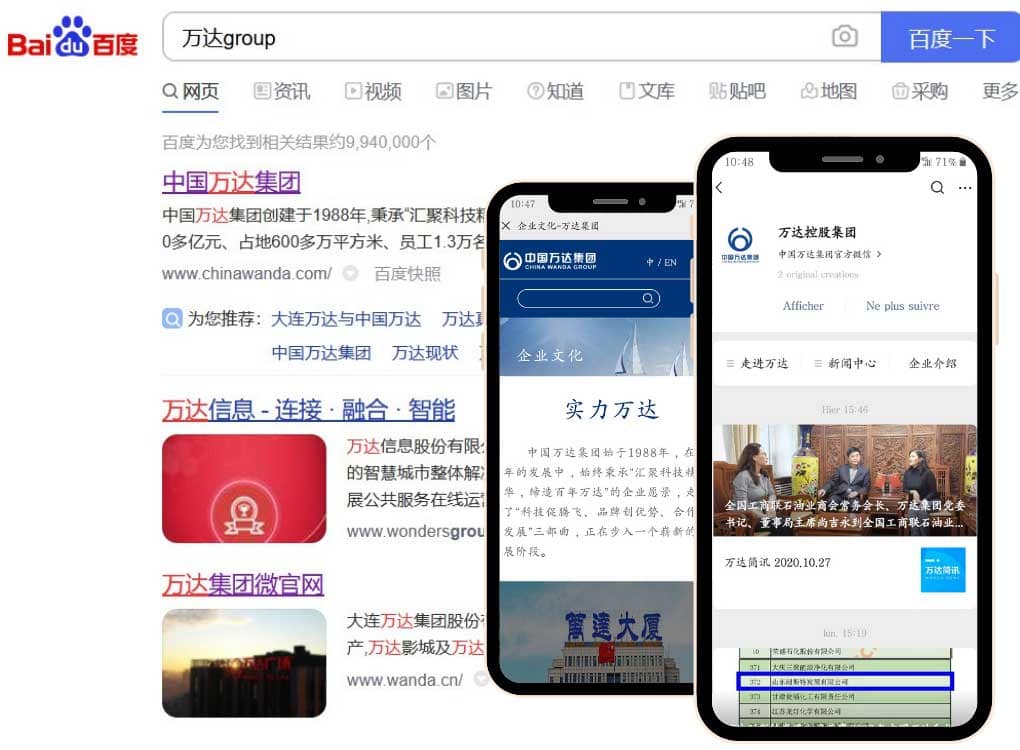

Chinese Website or Webpage

Your introduction in Chinese is just as important. You need a website, or at the very least, a webpage that can rank on Baidu. Baidu is China’s primary search engine.

A Chinese website is the first step in your Chinese marketing campaign. Investors will be able to get to know you better and see how you adapt to new markets. You won’t get any SEO without it. Without SEO, you’ll have less visibility and chances of getting a Press release. This can be a negative point for your online reputation…CQFD.

Here are some points to remember:

- Regular original content in mandarin

- Chat live if you are able

- Contact Information

- Hosting in China and neighboring countries

- There are no googles plugins or tools

- All of the above

Baidu SEO is crucial in China to fundraise

SEO, or Seach Engine Optimization, is the best and most cost-effective tool for your company. It is also crucial. An effective SEO Campaign can make the difference between strong visibility and credibility, or ranking on page 623 in Baidu search.

How do we proceed? Market research is the first step. Who are your competitors? What are the most important keywords? How long would it take for your landing pages to be ranked on these keywords?

Once we have decided on keywords, we can start writing quality content that will please not only our readers but Baidu’s algorithm. Let’s keep it simple: The higher your article is optimized to please Baidu, the greater your chances of ranking high. Your content will get more engagement if it is more appealing to the reader. Baidu will rank higher if it has more engagement from internet users.

BAIDU SEM (and Other Paid Ads)

SEO is time-consuming so it’s a good idea to combine paid ads with SEO. Paid ads can bring you the traffic and visibility that your website needs to get started.

Baidu is the most well-known platform for Paid Ads, however, many other platforms offer similar services at lower prices. Particularly interesting is Toutiao’s paid advertising on Weibo.

Baidu PPC Efficient?

Although it is instant traffic, PPC (pay-per-click) is more effective than organic traffic. However, the quality of traffic you get is often lower than that which you would get organically. What professionals click on Ads? In reality very few. SEO traffic is generated from natural search results.

Paid Ads on Toutiao

Toutiao, which was translated to “Headlines” in 2012, was created by Douyin, a Chinese tech company. Toutiao, China’s most popular mobile app for news aggregation and content creation, is also known as the “Buzzfeed” in China. As of July 2020, it had 1.5 billion active monthly users.

Toutiao is a great way to get the attention of Chinese consumers. They spend more time on Douyin, Toutiao and Wechat than they do on Wechat. We can however see that Toutiao’ers are receiving a customized feed of posts by analysing the content they interact with. They also accept account settlements that are based on performance (CPC and CPA ..).).

There’s 3 types of paid ads available on Toutiao:

- Takeover Ads : shown on fullscreen upon opening the app

- Streaming Feed Ads HTML2_ Video format ads that blend in with users’ feeds for seamless viewing.

- Feed Ads Feed ads are displayed in users’ feeds. They come in many formats. This type of advertisement supports CTA and can redirect users to other apps.

PR & Forums: A great way to promote a fundraising project here in China.

We love forums and press releases when it comes to improving China’s online reputation. Why you’ll ask me? It is third-party content that mentions your company.

A press release with a backlink will not only give authority to your site but it can also boost your company’s credibility and legitimacy.

When a third party is introducing/recommending your company, it puts its own reputation on the line. It is a good indicator that you aren’t a fraudster, for readers.

Because of the organic engagement, UGC (users generated content) generates, forum topics rank higher on Baidu. One thing you should remember in China is that regardless of your industry, your company must gain trust from the investors/consumers before you can receive anything.

What do netizens trust more? Their pairs write the content.

This has been our business for over a year. We also have a strong PR network. We will connect with Chinese Media, a reference in the industry, and we will begin generating content for platforms like Zhihu or Baidu Zhidao as well as niche forums.

Contact us to get in touch with Chinese private investors

Contact us, we have solutions for you