Luckin Coffee vs Starbucks battle in China: How wins?

Chinese rival to Starbucks, Luckin Coffee, is seeking a daring comeback two years after an accounting scandal rocked its U.S. operations.

Luckin’s net income rose by 72.4% to 3.29 billion RMB ($487.92 million) in the company’s second quarter financial report. Revenue in China dropped by 40% to 3.68 billion RMB ($544.5 million) in the third quarter of fiscal year 2022, according to a report by Starbucks.

The current gap between Luckin and Starbucks is under 400 million RMB ($59.3 million). And by March of 2022, there were more Luckin Coffee locations than Starbucks. When comparing Starbucks’ 5,400 Chinese locations to Luckin’s now over 7,100, the latter is a clear winner. And as its finances improve, Luckin is rapidly gaining ground on Starbucks.

The company’s successful resurgence may be traced largely to its constant efforts to introduce new goods and form new partnerships. The “raw coconut latte” debuted for the coffee chain in 2021 and quickly became a bestseller, selling 10 million cups in the first year. On the one-year anniversary of its release, Luckin has sold an astounding 100 million cups. Also, the fact that Olympic star Eileen Gu was endorsing the coffee brand helped boost sales.

As a result of the location of its outlets, Luckin avoided being shut down as frequently as Starbucks was during the pandemic. Luckin avoided the hustle and bustle of the city by shopping at office supply stores and college bookstores. Luckin’s CEO Jinyi Guo said that even in “these very closed-off settings,” the coffee shop “remained normal operations.” The rent and labor costs of retailers in these regions were kept low because they were mostly self-pickup operations.

The severe covid regulations in Beijing and Shanghai were a major setback for Starbucks. Before the pandemic hit, the American coffee business was doing well, with first-quarter revenue of $860 million. Despite a recent decline in sales, Starbucks China remains committed to its “target of reaching 6,000 locations in the Chinese mainland market by the end of this year.”

How Starbucks’ revival stacks up against Luckin’s recent coffee growth is an open question. Despite Luckin’s recent success, it will be some time before the company can regain its former financial and reputational standing in China’s coffee market.

Past setting up stores in China, you need to think about Marketing

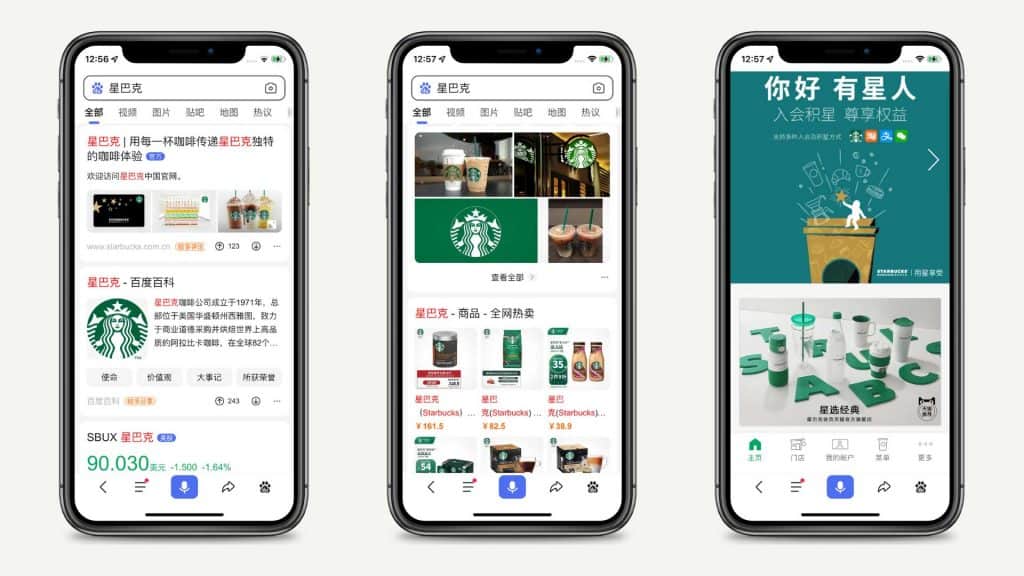

Furthermore, you have to consider the difference in technologies used for marketing in China. There’s no Facebook or Twitter to run your promotional campaigns. Instead, you’ll have Weibo, WeChat, and other social media platforms that are unique to the Chinese market.

Weibo is a social networking platform that allows users to freely post, read, and respond to content, much like Twitter (including the use of hashtags). Because of this, users are more likely to engage with one another and brands through posts and comments, which benefits both parties.

Brands can effectively advertise, run promotions, and partner with influencers on Weibo. The app is very visual, like Instagram, and popular content will be featured in a “trending” section, in contrast to WeChat’s emphasis on text. As an added bonus, the cost-effectiveness of Weibo’s sponsored advertising system is generally praised by brands and marketing experts.

For instance, Starbucks china published regularly on Wechat to promote their seasonal goods or activities the franchise take part in, but users can also access their WeChat shop to purchase goodies or order a coffee.

Chinese Website

Getting your coffee franchise a Chinese website will tie the rest of your effort together and it will allow your brand to have a direct presence on Baidu important for brand credibility.

Having a Chinese website is also crucial if you want to attract Chinese investors and franchisees.

Coffee franchise in China: What we think

Since China’s coffee market is still expanding, now is the time to capitalize on the country’s rising middle class by opening a new coffee franchise there. If you want to join the Chinese market and expand your coffee franchise there, you should focus on making your brand appealing to Chinese consumers before you worry about recruiting franchisees, and perhaps you can even design goods to sell on a Tmall flagship shop like Starbucks and Luckin coffee.

Want to get started as a coffee franchise in China?

Contact GMA!