China’s virtual KOL market will be worth USD 235 Million

The market for virtual influencers in China is only a small part of the larger 100 million RMB KOL marketplace. However, it has great potential.

According to iQiyi research, 64% Chinese 14-24 year-olds viewed virtual idols in 2021.

KOL marketing meets Augmented Reality Technology: Virtual Influencers in China

There are many types of virtual influencers in China. We will see that they are not just independent and branded influencers. There are also differences between virtual KOLs who promote via social media, virtual KOCs who have more intimate relationships with consumers and virtual Idols who take their influence to the next level by performing.

Brands hesitate to work with vurtual influencor

Brands are keen to work with virtual influencers in China, especially when it comes live streaming. During 2020’s Double 11 shopping festival, Philips, L’Oreal, Unilever, and L’Occitane all used virtual hosts in their product promotion live-streams. In a

China’s celebrity culture is in a state of flux like never before. Online lists that rank celebrities based on popularity were banned. A government is targeting fanclub culture because it is perceived as detrimental to the mental health and well-being of young Chinese people. Individuals are being targeted.

This environment has led to a growing interest in virtual idols and influencers being used as marketing vehicles for brands. Virtual celebrities will not behave in a bad way.

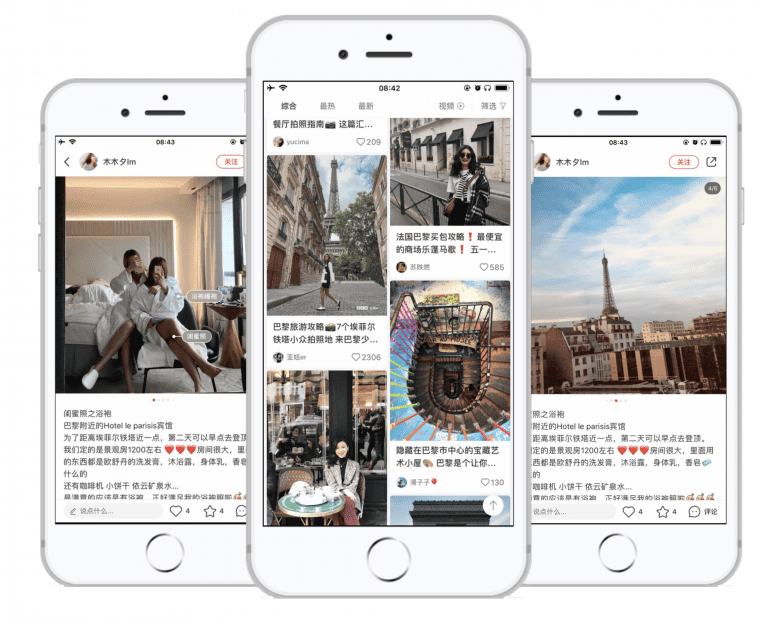

While the first generation of virtual idols representing the West, such as Lil Miquela and Noonoouri, is still strong, a new crop of virtual idols is emerging from China. These virtual idols compete with real KOLs (key opinions leaders) on social media platforms like Xiaohongshu or Weibo to market their products.

Mascots 3.0

Virtual idols aren’t as old as we might think. A similar role is played by brand mascots such as Ronald McDonald, KFC’s Colonel Sanders and the Michelin Man. China has had an iconic pair of grandparents that appear in commercials for medicine for years. New technology has created a new type of virtual idol who is taking things to a higher level and turning it into big business. Data from iiMedia Research shows that China’s virtual idol market was valued at RMB 3.46 Billion ($487 Mn) in 2020. This is an increase of 70% year-on-year and will reach RMB 6 Billion ($875.9 Million) by 2021.

It’s not just the idols that are going to be the biggest beneficiaries. The value of the industries, which include AR and VR, is expected to increase from RMB 64.5 trillion ($9 billion) in 2020, to RMB 107.5 miliarde ($15 billion) in 2019. ARK’s Big Ideas 2021 report estimates that worldwide virtual world revenues will surpass $400 billion by 2025

Noonoouri

Noonoouri, a virtual idol created by Munich creative agency Opium Effect, is currently the darling of fashion. It’s designed to look doll-like and unrealistically realistic. Lil Miquela is another well-known virtual idol. She was created by a young woman with mixed Brazilian and Spanish ancestry, and lives in Los Angeles. Both Noonoouri as well as Lil Miquela have collaborated with many luxury fashion brands.

Luo Tianyi

Luo Tianyi is one of China’s virtual idols. She is a Vocaloid singer and performed at the 2021 Spring Festival Gala. Pechoin and Three Squirrels have worked with her, as well as Chang’an Automobile, Chang’an Development Bank, Pechoin, Three Squirrels (KFC), Whisper, Huawei, Whisper, and Whisper), among others. Mota Shikong’s Jyanme has 3 million followers and more than 100 million video views. Jyanme has worked for Mengniu Dairy and PUBG Mobile. Hey Tea is another example. Ranmai Technology introduced “metahuman” Ayayi in May. She has previously worked in luxury with Guerlain and Louis Vuitton.

Is it really possible for virtual idols to be so different from real-life KOLs. Both have their own MCNs, multi-channel networks. There are also questions about the authenticity of traffic in both cases. For example, livestreams can be falsified by viewing figures.

Lot of MCN’s agency for real idols that they are now working for an agency to help virtual idols. He said that the same issues with agencies creating fake numbers are present in the virtual idol industry, regardless of whether it is with followers, livestreams, or any other digital metrics.

There may be some backlash against virtual idols that are not real. Ling, a virtual Chinese idol, has 150,000 Weibo followers and has worked for brands like Tesla, Keep and Tissot. Ling’s post on Tesla’s Xiaohongshu page received only 23 likes, while a Tissot post received just 20.

Case study : Florasis

Florasis, a Chinese beauty brand, announced the launch its virtual influencer. It is named after Florasis. Florasis is the first domestic brand to develop such a realistic avatar. Perfect Diary already has its virtual persona Xiao Wuzi, a cosmetics brand. source

Florasis (the avatar), is intended to embody the brand’s focus on beauty and traditional Chinese heritage.

Florasis’ virtual avatar. Source: Weibo@Hua Xi Zi Florasis.

Florasis is a 2017 startup that has grown quickly. Its sales in 2019 surpassed 1.1 billion RMB, which is 25 times more than the previous year. Florasis made great strides in 2020 when it sold more than 3 billion RMB, which is a 165.4% increase year-over-year.

How will the Virtual Influencer benefit the Brand in China?

The direct answer is that the avatar will help Florasis increase its sales. It is unclear, despite Florasis’s recent launch, what role Florasis (the Influencer) will play. She will appear only in brand content, or she may be given a voice and appear in videos and live streams. She will have her own social media accounts and be able to appear alongside brand ambassadors.

It is still too early to know if or how she will benefit the brand. We do know that avatars like this can be used to strengthen the brand’s image and help customers feel more connected to the brand.

Other brands are using virtual influencers in China

Virtual influencers are becoming more common all over the globe. However, most of them operate independently and are not owned by brands. For example, Chinese influencer Luo Tianyi (Luo Tian Yi ). She was a virtual singer who was born in 2012. Luo has attended many events offline with celebrities such as Austin Li’s livestream. She has over 5 million Weibo followers and works with brands like Huawei and Master Kong (Kang Shi Fu), an instant noodles brand.

read also